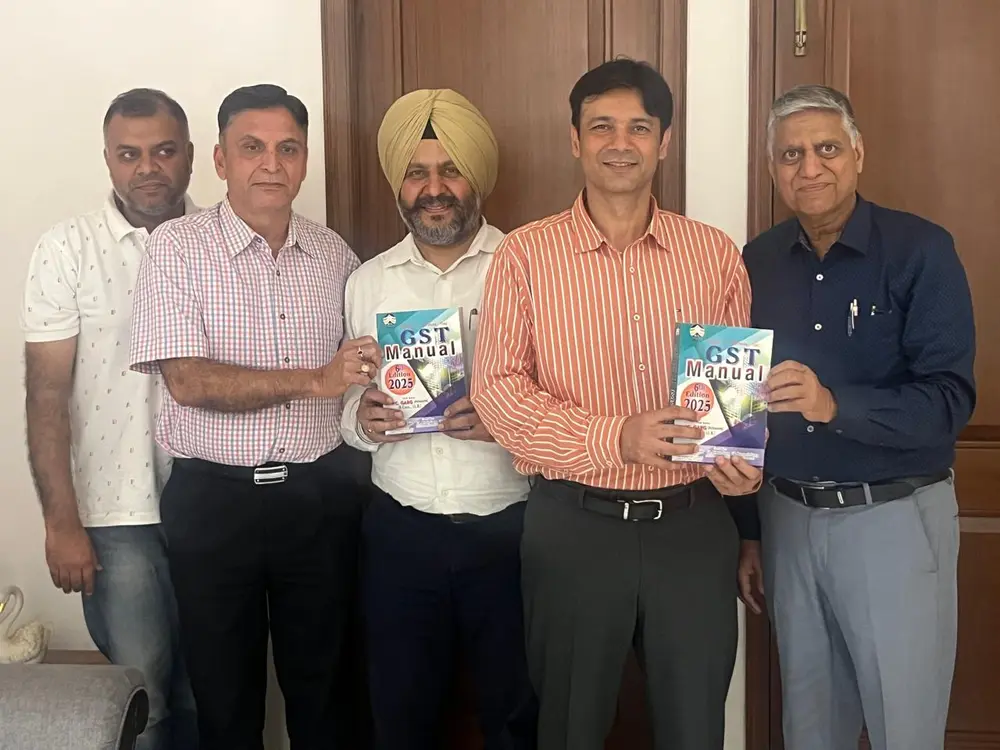

Commissioner of Tax Punjab releases Garg’s comprehensive GST guide- ‘GST Manual’ Edition 2025

SAS Nagar, April 10: In a significant initiative to enhance understanding of Goods and Services Tax (GST) regulations, Varun Roojam, IAS, Commissioner State Tax Punjab along with H.P.S. Ghotra, Additional Commissioner State Tax today unveiled the latest edition of ‘GST Manual’ – a carefully compiled book authored by P.C. Garg, Advocate in collaboration with Lavinder Jain (Additional Commissioner GST, Retd.), C.A. Ritesh Garg and C.A. Puneesh Garg.

SAS Nagar, April 10: In a significant initiative to enhance understanding of Goods and Services Tax (GST) regulations, Varun Roojam, IAS, Commissioner State Tax Punjab along with H.P.S. Ghotra, Additional Commissioner State Tax today unveiled the latest edition of ‘GST Manual’ – a carefully compiled book authored by P.C. Garg, Advocate in collaboration with Lavinder Jain (Additional Commissioner GST, Retd.), C.A. Ritesh Garg and C.A. Puneesh Garg.

On the occasion, author P.C. Garg said that the 2025 edition of GST Manual provides a structured and user-friendly approach to GST laws, including Acts, Rules, Notifications, Orders and Expert Commentary. He said what makes this publication stand out is its systematic reference, where every clause is linked to its corresponding rule and vice versa, ensuring clarity and ease of navigation for professionals and stakeholders.

Additionally, relevant notifications, orders and expert insights have been provided under each clause and rule to facilitate a comprehensive understanding of GST provisions, Garg added. He added that the book has been prepared with the guiding principles of 'authenticity, simplicity and affordability', making it a reliable and accessible resource for tax practitioners, businesses and policy makers.

It aims to serve as a valuable reference in effectively navigating GST laws. Tax Commissioner Varun Roojam and Additional Tax Commissioner HPS Ghotra appreciated the authors for their dedication to simplify GST complexities and provide an indispensable tool for tax experts and businesses.

It is pertinent to mention here that the author P.C. Garg, a distinguished advocate with 47 years of experience in tax laws, has been contributing in the field of legal literature since 1985. His co-authors - Lovinder Jain, CA Ritesh Garg and CA Puneesh Garg - bring their extensive expertise in GST regulations, making the GST Manual a definitive and authoritative guide for professionals.