Tax System in India: The Middle Class and the Popcorn Trouble

Taxes are the foundation of any economy, providing revenue for public services and infrastructure. But in India, the tax system often seems like a burden for the middle and lower income groups. The recent debate over GST on popcorn has raised the question of whether India's tax system is really fair.

Taxes are the foundation of any economy, providing revenue for public services and infrastructure. But in India, the tax system often seems like a burden for the middle and lower income groups. The recent debate over GST on popcorn has raised the question of whether India's tax system is really fair.

India's Tax System vs. Tax Policies of Developed Countries

India has a mix of direct and indirect taxes. Income tax rates range from 5% to 30%, which follow a progressive structure. The corporate tax rate is 22%, which is globally competitive. But indirect tax rates like GST, ranging from 0% to 28%, apply equally to everyone, making it more burdensome for the middle and lower classes.

In contrast, developed countries like the US, the UK and Nordic countries also have strong public welfare schemes along with progressive tax systems. Income tax rates in the US go up to 37%, but tax credits for education and healthcare reduce this burden. In Nordic countries, tax rates are over 50%, but citizens get free healthcare, education, and comprehensive social security. In India, taxpayers get no such benefits, leading to growing discontent.

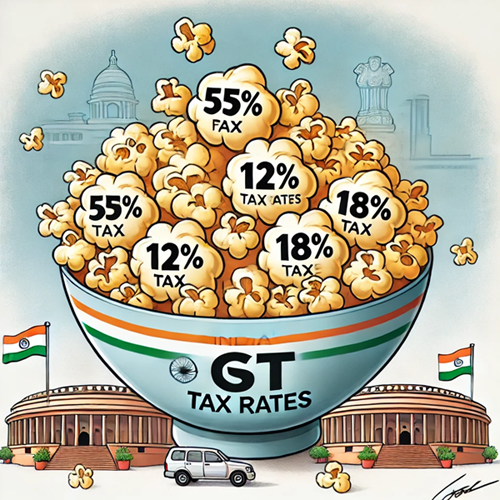

The Popcorn Controversy: A Grain of Truth

Recently, the GST Council fixed different rates on popcorn—5% on non-branded salted popcorn, 12% on packaged and branded, and 18% on caramel popcorn. The move was heavily criticised, and termed as an unnecessary intervention. Taxing popcorn based on flavour and type seems ridiculous in a country where basic sectors like education and health still lack proper financial management.

The controversy highlights a deeper problem with India’s tax system: an overreliance on indirect taxes like GST, which fall more heavily on the middle and lower classes than the rich. A billionaire enjoying his expensive coffee gets tax breaks, while the common man has to identify the type of popcorn before going to the cinema.

Why the burden on the middle class?

The taxpayer base in India is the smallest in the world, with only 5% of the population paying income tax. The government is highly dependent on the salaried middle class for revenue due to exempted agricultural income and a large informal economy. At the same time, indirect taxes make everyday life more expensive for the poor.

In contrast, the tax burden in developed countries is more evenly distributed. For example, the UK has child tax credit and tax relief for senior citizens, while high taxes in Germany fund free education and universal health care, giving taxpayers a sense of value.

A satirical view: Popcornomics

This popcorn controversy is symbolic of a system that focuses on “easy targets”. If popcorn can have three different GST rates, should we now be willing to tax samosas based on their spiciness? It seems strange that policymakers are focusing on film snacks while ignoring the larger economic imbalances.

Way Forward

India's tax rates may not be too high, but its reliance on indirect taxes and limited benefits of public services make it unjust. Widening the taxpayer base, simplifying policies, and investing in universal welfare services can correct this imbalance.

After all, the tax system should give a sense of contribution to the nation's development, not punish the middle class. Otherwise, government policies on popcorn may leave nothing but a bitter taste for the public.