Haryana Chief Minister Naib Singh Saini said that these reforms in GST will prove to be a milestone in the direction of self-reliant India.

Chandigarh, September 6 - Haryana Chief Minister Naib Singh Saini said that the GST reforms, which were announcmented by Prime Minister Narendra Modi at the Red Fort on Independence Day, 2025, have been implemented within just a month. This is proof of Modi's guarantee, which is always fulfilled. These reforms in GST will prove to be a milestone in the direction of self-reliant India. These reforms will also play an important role in realizing the Swadeshi, Make in India appeal given by the Prime Minister.

Chandigarh, September 6 - Haryana Chief Minister Naib Singh Saini said that the GST reforms, which were announcmented by Prime Minister Narendra Modi at the Red Fort on Independence Day, 2025, have been implemented within just a month. This is proof of Modi's guarantee, which is always fulfilled. These reforms in GST will prove to be a milestone in the direction of self-reliant India. These reforms will also play an important role in realizing the Swadeshi, Make in India appeal given by the Prime Minister.

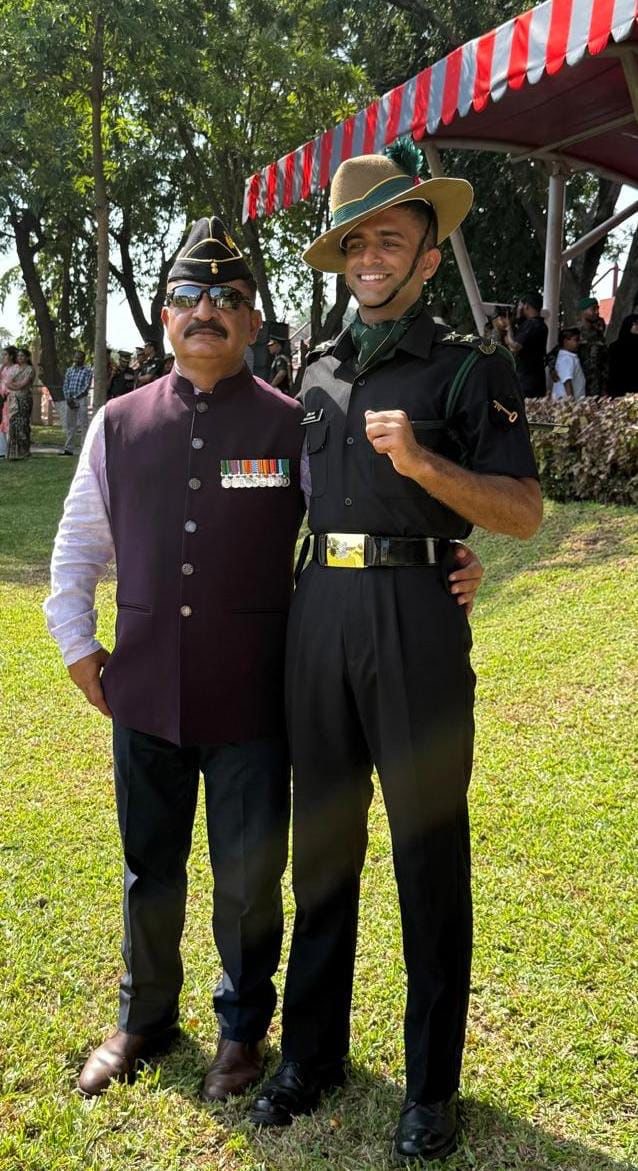

The Chief Minister was addressing a press conference held here today.

Mr. Naib Singh Saini said that GST has made the tax system easy and transparent. This has also removed the obstacles in trade between states and has fulfilled Prime Minister Narendra Modi's dream of One Nation-One Tax-One Market.

He said that in the 56th meeting of the GST Council, many important decisions have been taken to reduce the burden on the citizens and strengthen the economy. Terming these decisions as welcome steps, the Chief Minister said that rationalizing GST taxes will make daily use items cheaper. This will increase the savings of the middle class and the market will benefit greatly from shopping during the upcoming festivals.

He said that now there will be only two standard rates of GST in the country. One is 5 percent and the other is 18 percent. Apart from this, other special rates have been kept for specific items, including a special rate of 40 percent. Two rates of 12 percent and 28 percent have been abolished. The classification of rates has also been improved. This will reduce classification disputes and benefit the taxpayer by avoiding litigation.

GST has been reduced on items commonly used by citizens and some taxes have been abolished. Apart from this, cess has also been abolished to further reduce the tax burden on the people. The invented duty structure on textiles and fertilizers has been removed.

He said that the registration process has been made easy. This will enable auto-registration within 3 days for low-risk applications. The system includes issuance of provisional refunds specifically on Aadhaar and within a fixed time frame.

The Chief Minister said that the reforms made by the GST Council have taken into account the interests of both agriculture and farmers. Haryana is an agricultural state and considering the appeal of Haryana, the GST Council has reduced the GST rates on agricultural implements used in crop residue management. For this, he has expressed gratitude to the Union Finance Minister Nirmala Sitharaman.

He said that the Council has made GST zero on packaged milk and cheese, while the rates on ghee, butter and dry fruits have been reduced from 12 to 5 percent. These changes will reduce prices, help in controlling inflation and provide nutritious food to all. Also, GST on daily food items like roti and parantha has been completely abolished.

This will give a boost to traditional food businesses. These steps will also give a boost to the food processing industry of Haryana, help farmers get fair price for their crops and create employment opportunities in rural areas.

The Chief Minister said that the GST Council's decision to reduce the GST rate on agricultural implements like irrigation and ploughing machines from 12 to 5 per cent is also a good step. This will reduce the cost of agricultural implements for farmers. Bio-pesticides and fertiliser inputs like ammonia, sulphuric acid and nitric acid will now attract 5 per cent GST, which will reduce input costs and encourage sustainable farming systems.

Apart from this, the GST rates on tractors and tractor parts have also been reduced. In this, the GST on tractors with engine capacity below 1800 cc has been reduced to 5 per cent, while for tractors with engine capacity above 1800 cc, the rate has been reduced from 28 to 18 per cent.

Shri Naib Singh Saini said that the GST rate on solar and other renewable energy devices has been reduced from 12 to 5 percent, while the main textile inputs in the yarn and fabric category, which were earlier charged at 12 percent GST, will now be charged at 5 percent. GST on sewing machines has also been reduced from 18 percent to 5 percent.

The Chief Minister said that GST on essential life-saving medicines has been reduced from 12 percent to zero. In addition, GST on diagnostic kits like glucometers and reagents has been reduced to 5 percent. GST on life and health insurance has been reduced from 18 percent to zero.

He said that in another major relief to the general public, the GST rate on petrol in small cars up to 1200 cc and diesel up to 1500 cc has been reduced from 28 percent to 18 percent, and the same 18 percent rate will also be applicable on motorcycles with engines up to 350 cc.

Similarly, the GST rate on cement has been reduced from 28 percent to 18 percent. The rates of some specific items have also been revised. GST on tobacco products, pan masala and cigarettes has been increased to 40 percent, while the existing compensatory cess will remain applicable. The GST rate on sugary aerated water and caffeinated drinks has been increased to 40 percent.

The Chief Minister said that since 2017, continuous efforts have been made to simplify and rationalize the GST structure. This has broadened the tax base in Haryana and increased GST collection. Haryana's net SGST collection has increased from Rs 18,910 crore in 2018-19 to Rs 39,743 crore in 2024-25.

This represents an increase of 110 percent. In the year 2024-25, Haryana stood at 5th position among the major states of the country in total gross GST collection. Haryana's net SGST collection is growing at an impressive rate of 20 percent in the financial year 2025-26.

Chief Secretary to the Chief Minister Rajesh Khullar, Excise and Taxation Commissioner Vinay Pratap Singh, Director General of the Information, Public Relations, Language and Culture Department K Makrand Pandurang and Media Secretary to the Chief Minister Praveen Atre were present on this occasion.

.webp)